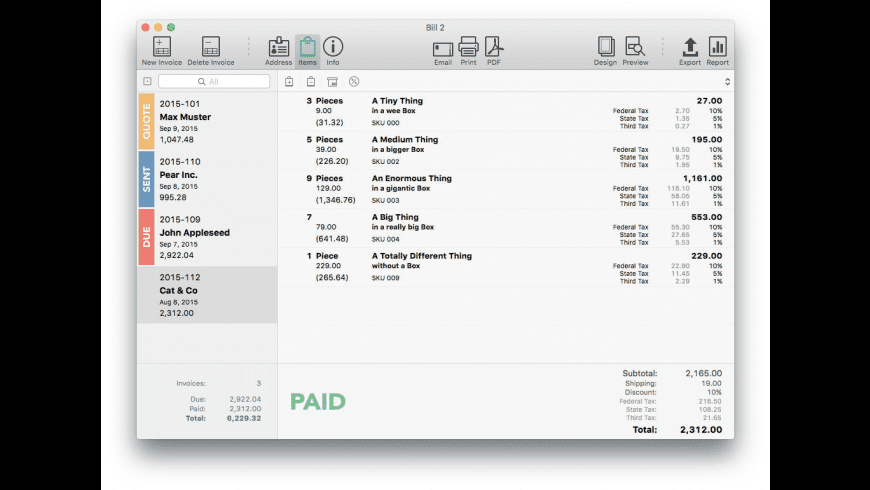

Bill 2 5 4 – Invoicing Made Painless And Fundamentals

From marketing your business to paying taxes, managing customer information to completing client work, you’ve got your hands full. That’s why you need a fast, simple invoicing system that gets the job done quickly and professionally.

- Bill 2 5 4 – Invoicing Made Painless And Fundamentals Pdf

- Bill 2 5 4 – Invoicing Made Painless And Fundamentals 3rd Edition

- Bill 2 5 4 – Invoicing Made Painless And Fundamentals 9th Edition

- Bill 2 5 4 – Invoicing Made Painless And Fundamentals 2nd Edition

Download Invoice Templates for Free

This processing option lets you specify the version of the Invoice Print program (R48504) to use. Invoice Print Version (R48504) Enter the version of the Invoice Print program (R48504) to use. If you leave this processing option blank, the system does not print invoices during invoice generation. The mechanism called e-Way Bill was brought introduced implementation of Goods and Service Tax Laws in India. In previous era, the mechanism called way bill was in force under VAT Laws of concerned State.The Way Bill had to be obtained from VAT Authorities to allow movement of goods in specified manner, which was nearly nightmare for the taxpayers because of its mechanism.

Why should invoicing your clients be expensive for your business? Now you can create invoices for free without having any accounting background. We provide free invoice templates for businesses to use to get paid for their work, products and services.

Microsoft Word Invoice Template

Create streamlined custom invoices in minutes. Change colors and fonts, add images, information, and more to meet your business needs.

The Best Way to Invoice

Automate your invoicing with Free Invoice Creator’s fully automated invoicing software.

Create My Free InvoiceMicrosoft Excel Invoice Template

Leave math mistakes behind with invoice templates for Microsoft Excel. Enter your rates, line item charges and more and let Microsoft Excel do the work for you, your clients, and your business.

Google Sheets Invoice Template

Get the calculation power of Excel wherever you have the internet. Download, create, edit, save, and send to your clients for streamlined, beautiful invoices.

Create an Invoice with FreshBooks

Craft readable, functional invoices in a fraction of the time with free downloadable invoice templates. Just download, design, customize, save and send your business invoices for effortless billing.

Create My Free InvoiceFree Invoice Templates for Businesses

Sending great-looking invoices is important to your business. But taking the time to create and design one from scratch isn’t always possible. Instead of reinventing the wheel, try a simple and free invoice template that you can design and customize to fit your unique business and its services. Simply choose one of our blank invoice templates, download, edit and send.

The Best Way to Invoice

Collect online payments, send recurring invoices, manage your business finances and more with Free Invoice Creator.

Create My Free InvoiceBlank Invoice Template

Create the invoice you’ve always needed with our blank invoice templates. Add in the details and information you need, send and get paid fast.

Hourly Invoice Template

Billing for your services hourly can lead to complicated calculations on your invoice. Make totaling up the bill simple with our built-in calculations on our free invoice templates.

Retainer Invoice Template

Get paid by your clients upfront for your business services faster than ever before with a customized retainer invoice template.

Credit Invoice Template

Did your client overpay you last month and you need an invoice to reflect that? Get a free credit invoice template to do just that.

Standard Invoice Templates

Create a tried-and-true invoice for all your business needs in a flash. Just download the invoice template, edit and send to clients.

The Best Way to Invoice

Professional businesses deserve professional invoicing solutions. Send detailed, 100% custom invoices.

Create My Free Invoice

Create My Free InvoiceRecurring Invoice Template

Charging the same fees for services every month doesn’t have to mean creating new invoices every month for your clients. Save time and createCreate quick, painless recurring customer invoices to get the job done.

Why Use an Invoice Template?

Owning your own business means most operations fall squarely on your shoulders, including invoicing your clients.

Make the process of creating invoices less of a hassle with free invoice templates that you can customize to look like you spent hours designing them. Just download your chosen invoice template, add your images and charges, save and send to your clients for quick, painless billing each month.

Clearly laying out all service information and charges on the invoice makes it less likely you’ll receive phone calls and emails with questions about your invoice or disputes over your charges. Instead, just sit back and wait for payment from clients.

Set your business apart with a clear, concise invoice for all your business services.

Benefits of Using Invoice Templates

Spend less time on billing and invoicing and more time working on the important things that keep your business running with a free invoice template.

Creating great-looking, professional invoices from invoice templates provides many benefits, including:

✔ Process and send client invoices in minutes

✔ Downloadable in .DOC, .XLS, .CSV, .PDF formats and more

✔ Organize client information and account status

✔ Create a lasting professional impression with your clients

100% Custom Invoice Templates for Your Business

Keep some business secrets for yourself with customizable invoice templates that look like a designer made them. Just download, edit and send your invoices for quick payment.

Free Downloadable Invoice Template Formats

Free invoicing templates mean you don’t have to wrestle with complicated invoice software or pay someone to do your monthly billing for your business. Take care of creating, processing and sending invoices in minutes with professional-looking invoices your clients will love.

Word Invoice

Use a program like Microsoft Word that you already know and understand to create great-looking invoices. Change fonts and colors, upload logos and images and more for an invoice your clients want to pay.

Google Docs Invoice

No Microsoft Word? No problem. We’ve got you covered with a free invoice template in Google Docs, all ready for you to download, customize and send for painless billing on the go.

Excel Invoice

Automatically calculate totals right in your invoice thanks to the built-in functions of Microsoft Excel. Charge for your hours worked, materials needed, miles traveled and more.

Google Sheets Invoice

Get all the functionality and ease of working with Microsoft Excel wherever you go with Google Sheets. Add charges and calculate totals in seconds, all while creating a custom invoice that you can quickly email to your clients.

PDF Invoice

Create printer-ready invoices with a downloadable PDF invoice template. Simply download the invoice template, customize it to meet your needs and save. Your invoice is ready to print or email directly to your client.

Even More Free Invoice Templates

What makes invoice templates better than other billing methods? They are an easy and affordable way to get paid for your work and keep your business finances in check.

- Graphic design

- Contractors

- Freelancers

- Photography

- Web design

- Video production

- Attorneys

- Auto repair

- Painting

- Construction

- Hotels

- And more…

What is an Invoice Template Used for?

Your business deserves an invoicing system that’s as professional as you are, without requiring bulky software or expensive professionals.

Sending a complete invoice that lists all your business charges – hours worked, money billed for supplies and more – lets your clients know exactly what they’re paying for. This reduces questions about your invoices, helping you get paid faster and with less hassle.

Accept payment any way you want with Free Invoice Creator, including PayPal, ACH bank transfer, check and more. You get the flexibility to run your business the way you want without forcing you to use one payment form over another.

A simple invoice service will help you stay on top of your business’s finances by quickly tracking the client work you do, organizing client information and knowing which accounts are current and which are overdue. This decreases your stress and frustration at tax time, freeing you up for more important things like growing your business.

How to Customize Your Free Invoice Template For Your Business

Your business is unique to you, so you should send an invoice that reflects that. With free invoice templates from Free Invoice Creator, you can get customized invoices in minutes, all at a price you can afford.

1. Fill in Company and Contact Information

Add in your business name, your logo and how clients can contact you in case they have questions or concerns about your invoice.

2. Add Date and Invoice Number

Make sure your invoices are traceable and trackable – both for your records and your clients’ records – for easier checking on accounts that are current and those that are overdue.

3. Include Descriptions and Service Rates

This is the meat of your invoice; list everything on your invoices that you’re charging your client for, and any credit for discounts or prepayment. Include as much information on your business services as you want to decrease client questions.

4. Add Sales Tax

Don’t get caught with unpaid sales taxes come tax time. Be sure you include all applicable state and local sales taxes on your invoice so you give your clients the most complete bill for your services possible.

5. Calculate Amount Due

Whether you total things up by hand or let a program like Microsoft Excel or Google Sheets do the work for you, giving your client a total amount due is essential to getting paid in full once your invoice has been received.

6. Note Terms

In this section of your invoice, include information on how you would like to be paid, how quickly you want to be paid and more, so your clients aren’t left guessing about important details.

No-Worry Recurring Invoices

Do you invoice a client for the same thing each month? Create one invoice and set it to recur monthly for worry-free invoicing.

Faster Payments with Online Processing

Rather than wait for a check in the mail, accept online payments via PayPal, ACH bank transfer and more to get paid up to twice as fast.

Safe Storage in the Cloud

Keep client information accessible – but protected – at all times, with cloud storage. From invoicing history to client contact information, it’s all there.

See What Our Users Have To Say

“It’s beautiful and really well designed. The invoicing, accepting online payments and keeping track of expenses couldn’t be simpler.”

Roman Mars

Creator & Host of 99% Invisible

Download Your Free Bill Template

Create My Free InvoiceGST invoice is tax compliance issued on the supply of goods or services by a taxable business or person registered under the GST policies of India. GST invoice format is a sequential arrangement of information; the standardized format is followed by suppliers while issuing invoices to their clients.

Any business issuing tax invoices must be well versed with the GST invoice rules. No business or company shall compromise on the mandatory rules as it plays a vital role in tracking imports, exports, and other taxable services. Issuing GST invoices for each purchase and sales transaction streamlines the processes of GST returns filing and claiming credits.

Alongside, adhering to the GST invoice format enables businesses to gain better working capital. It helps suppliers get paid faster than usual, increasing the credibility of the business. However, understanding GST invoicing’s essentials is crucial for companies to generate error-free invoices and simplify transaction experience.

This article is a comprehensive guide on the GST invoice format. We have structured the invoicing explanations under GST, how to create a GST invoice, mandatory fields, changes, GST invoice rules, GST invoicing generator software in India, and more.

Invoicing Under GST

A transaction is defined as a “supply” on transfer, lease, exchange, rent, disposal, barter, or licensing of goods and services under the GST regime. Tax invoices on transactions must be issued within a specific time frame, as and when these events occur. Thus, taxpayers must issue invoices under certain circumstances, within a particular time as specified below.

- When the goods are being moved – suppliers must issue tax invoices either before or at the time of goods removal.

- When the goods are supplied without being moved – suppliers must issue tax invoices either before delivering goods or when the mentioned goods are made available.

- When there is a consecutive supply of goods – suppliers must issue tax invoices before each transaction.

- When GST is applicable on a reverse charge basis – suppliers must issue tax invoices on the receipt of such goods.

- When the goods are supplied based on approval – suppliers must issue tax invoices six months either before the withdrawal date or before or at the time of such withdrawal.

Likewise, a tax invoice must be issued in case of supplying services within the below mentioned period.

- Suppliers must issue tax invoices within 30 days of providing a service.

- In case of the consecutive supply of services where due dates are undetermined, suppliers must issue tax invoices within 30 days from such due dates.

- In case of the consecutive supply of services where due dates are predetermined, suppliers must issue tax invoices within 30 days from the actual payment date.

- In case of termination, suppliers must issue tax invoices at the time of termination of services supplied.

- For banks and other financial institutions, the due date is 45 days instead of 30 days.

GST registered person or business are usually provided with the GSTIN (GST Identification Number). Thus, it is mandatory for businesses with GSTIN to create and deliver GST invoices to the customers for the supply of goods and services. Likewise, when a person purchases taxable goods or services from a registered person, he/she will receive a GST compliant invoice from the supplier.

How to Create GST Invoices?

The government has standardized the GST invoice format for taxpayers across India. The mandatory fields of the standardized format are discussed below. It is ideal for adhering to these essentials as your ITC largely depends on corrective reporting and invoice numbering.

Numbering invoice forms are vital; serial numbers play a significant role in matching or mismatching the invoices. It enables a hassle-free, consistent credit flow.

Essentials of GST Invoice Format

A tax invoice is issued, aiming to charge the applicable taxes and claim ITC. To ease the compliance processes, the government has notified a standardized GST invoice format. It includes –

1. Information of the Taxpayer

- Supplier’s identity

- Full name of the supplier as indicated in the Permanent Address Number (PAN) card

- For registered businesses, it is mandatory to insert the company logo on top of the invoice format

- PAN number of the taxpayer or business

- GSTIN of the taxpayer or business

2. Shipping Address

- Place of supply of goods and services, the address must be mentioned.

- When the billing address is different from the shipping address, both the billing and the shipping addresses must be mentioned.

3. Buyer’s Information

- Name of the buyer registered under GST

- Address of the buyer

- GSTIN of the buyer

- PAN number of the buyer

4. HSN Code /SAC Code

5. GSTIN (Goods and Services Tax Identification Number)

GSTIN enables the government to track the type of goods or services supplied in the country. It is one of the required mandatory fields of GST invoicing as it determines if a business is eligible to claim ITC.

6. Invoice Number

Sequentially numbering invoices enables taxpayers to track bills as and when required.

7. Invoice Date

The date of the issue of goods and services

8. Type of GST

- UTGST: Union territory Goods and Services Tax

- IGST: Integrated Goods and Services Tax

- CGST: Central Goods and Services Tax

- SGST: State Goods and Services Tax

9. Rate of GST

0%, 5%, 12%, 18%, and 28% are the various tax rates applicable to taxable goods and services.

The tax rates applicable to the supplied goods and services depends on the GSTIN mentioned in the invoice.

10. Description of Goods and Services Supplied

- The standard name of the product or service provided

- Quantity of the goods or services provided

- The rate of amount for goods or services provided

- The cumulative amount of the supplied goods or services that are taxable

11. Extra Charges (if any)

- Shipping charges

- Traveling charges

- Additional Service charges

12. Terms and Conditions (if any)

13. Copy of Invoices

In the case of the supply of goods, businesses have to issue three copies of invoices. It includes –

- Original copy: it is the main invoice provided by a supplier to the buyer.

- Duplicate copy: it is the copy that is provided by the supplier to the person in charge of delivering the product or service.

- Triplicate copy: it is the copy retained by the supplier in case of future requirements as evidence of the transaction.

In case of a supply of a service, businesses have to issue two copies of invoices. It includes the original and the duplicate copy.

14. The Value of Amount

The total invoice amount must be mentioned in words. It helps avoid the manipulation of the total amount in numbers.

15. Digital Signature/Manual Signature

Any invoice is considered invalid without the signature of the supplier or the concerned taxpayer. Invoices must be either digitally or manually signed at the end, right under the total invoice amount in words.

16. Bank Details

Lastly, one of the essential fields of the GST invoice is bank details. Businesses get paid faster by enabling transaction modes on tax invoices.

Above mentioned essentials are the fundamental and mandatory fields on GST invoice format. However, most businesses provide additional information as per their convenience. It may include discounts, occasional PO (purchase order), invoice due, size, material description, email, contact details, etc.

Latest Changes in GST Invoice Format of India

It’s only been a decade since the implementation of GST in India. The government has brought several changes and reforms to streamline the taxation system and tax calculation in India. However, when India was getting on track with GST invoicing, the COVID-19 pandemic has forced the government to make some exceptions.

The latest changes in GST invoicing strive to achieve a comparatively larger number of registered taxpayers in the nation. Here we have coupled some of the latest changes that are to be adopted by the taxpayers.

- The government is mainly aiming to digitalize the process of returns filing to avoid taxation confusion and manual errors.

- To simplify the returns filing system and synchronize tax data, the GST council has mandated to file e-invoices.

- Once invoices, returns, or ITC tax data are uploaded on the Invoice Registration Portal (IRP), it automatically generates the Invoice Reference Number (IRN). It systematically aligns invoice data that enables the government to keep track of each transaction.

- The advanced process generates QR code and unique invoice registration numbers that enable taxpayers to claim returns with zero hassles.

- To experience consistency in taxation and returns filing, businesses or taxpayers must complete and upload GST compliances on the IRP.

The Indian government has notified various relations and tax measures for taxpayers registered under GST. Thus, there have been crucial changes in the GST invoice format, aiming to improve the returns filing system amid the ongoing economic crisis.

What is the Minimum Amount Requirement to Issue GST Invoice?

No tax invoice is required when the value of the goods or services supplied is less than INR 200. GST invoicing is not applicable under the following circumstances.

- In case goods or services are supplied to a non-registered recipient.

- In case the recipient does not request an invoice (if requested, it must be issued).

However, aggregate invoice or consolidated tax compliance must be generated at the end of each day on supplies for which a tax invoice has not been issued.

Common Invoicing Alternatives Under GST Invoice Format

Businesses or taxpayers can, at times, issue alternative tax invoices. Here are some of the common invoicing alternatives under GST as per the specifications of the GST council.

1. Reverse Charge Invoice

If a registered person purchases from an “unregistered supplier,” the recipient is liable to pay the tax. The recipient must issue an invoice on the date of the supply of such goods or services.

2. Receipt Voucher

In the event of receiving advance payment for supply, a registered merchant must issue a receipt voucher for the recipient’s advance amount.

3. Export Invoice

GST under exports varies slightly; the format of registration is different as taxpayers must obtain the Import Export Code (IEC). The format also quotes PAN (Permanent Account Number), which is legalized as a symbol of import and export by DGFT (The Directorate General of Foreign Trade).

Documentation and GST return filing procedures remain the same as per the standardized GST rules when you export under GST. However, the information drafted in the invoice for supplies made to a foreign country has a different GST invoice format. Invoice statements must include the respective country’s currency. Likewise, few other minor translations must be provided by the supplier.

GST Invoice Format for Exports

The export invoice must contain the following changes in addition to the information drafted in the standardized tax invoice.

- The supplier must include the LUT (letter of undertaking). It exempts the taxpayers from paying IGST and enables them to claim a refund on ITC purchases.

- The invoices must include both Indian (INR) and the client’s country’s currency in all three copies of invoices generated.

- It is mandatory to mention the client’s address in the invoices.

- The type of export has to be specified in the invoice. The invoice must contain the phrase “Supply planned for exports with IGST payment under the Special Economic Zone (SEZ)” or “Supply planned for exports without IGST payment under the LUT.”

4. Delivery Challan

A Delivery challan has to be issued while handling special deliveries, such as –

- The supply of liquefied gas, in which the quantity is unknown at the time it is withdrawn from the supplier’s registered office.

- Foreign transport of goods for professional work.

- Foreign transport of goods for reasons other than supply.

- Any other notified supply.

5. Debit Note / Credit Note

To review the taxable value or GST charged on an invoice, the supplier must issue a debit note, a supplementary invoice, or a credit note.

Debit Note / Supplementary Invoice

It is issued by the supplier to record increased taxable value or GST charges of the original invoice.

Credit Note

It is issued by the supplier to record decreased taxable value or GST charges of the original invoice. The credit note must be issued no later than September 30, after the end of the financial year in which the supply was made or the filing date of the corresponding annual return, whichever occurs first.

Debit notes, supplementary invoices, and credit notes must include the following details furnished below:

- Whether it is a “revised invoice” or a “supplementary invoice,” the document’s nature has to be specified.

- Supplier’s name, address, and GSTIN number.

- The numbering of these notes is mandatory. The consecutive serial numbers must contain either an alphanumeric character, numbers, special characters, dash, or a slash that is unique for each fiscal year.

- The date on which the document was issued.

- Name, address, and GSTIN / UID of the recipient (if the recipient is a registered taxpayer).

- Recipient’s name, address, and delivery address, with the name and code of the respective state (if the recipient is not registered).

- The serial number and date of the bill of supply or the original tax invoice.

- The taxable value of the goods or services supplied. It must include the tax rate and tax amount credited or debited to the recipient.

- A signature or digital signature of the supplier or an authorized representative.

6. Bill of Supply

A registered supplier can issue a bill of supply under the following circumstances.

- Supply of goods or services that are exempted.

- The supplier is a registered taxpayer under the composition scheme.

Salient Features of GST Invoice Rules

Only registered taxpayers or businesses can issue the GST invoice. It is not necessary to give a tax invoice if a business complies under other taxation rules. However, as per the current GST invoice rules, suppliers can provide an alternative for the GST invoice in such cases.

Best GST Invoice Generator Software in India

After years of deliberation, the government has finally streamlined the GST taxation system in India. Since the development of GST, companies have introduced GST billing software to automate invoicing and return filing as per the prescribed GST rules. Most GST invoicing software available in the market comes with the standard software packages.

Best GST accounting software offers several advantages over manual invoicing. Here are some of the unique Imprezz features that you must look for in the best GST software.

- Integrated Software System

- User-Friendly Interface

- Cloud Security

- Remote Access

- Automation

- Customization

- Single-Dashboard

- Tax Calculation

- Import/Export of Financial Data

- Customer Support

Bill 2 5 4 – Invoicing Made Painless And Fundamentals Pdf

Several companies offer free invoicing; however, the utility and features of such software are inferior. Taxpayers invoicing with a GST software must pay a license fee to use advanced features.

Conclusion

Bill 2 5 4 – Invoicing Made Painless And Fundamentals 3rd Edition

Adhering to the taxation policies is vital to create and empower convenient work experience. Taxpayers must adhere to the standardized GST invoice format to avoid taxation problems. To ease tax compliance, several companies across India offer GST invoicing software. You can avail of the seamless flow of credit and maintain your accounts effectively with proper formatting.

Imprezz GST invoicing software offers a robust IT system that enables businesses to manage purchases and sales. It provides various features, such as purchase order management, tally integration, import functions, etc. Streamline your GST accounting with our integrated software. The efficacy of the software eradicates the collaterals, such as time consumption and manual errors.

Bill 2 5 4 – Invoicing Made Painless And Fundamentals 9th Edition

With the onset of GST, it is an alarming time to adapt to GST accounting. If not, non-compliances under the current GST regime might result in credit loss. Imprezz is India’s pioneer of accounting software that has been successfully helping businesses stay GST compliant.

Bill 2 5 4 – Invoicing Made Painless And Fundamentals 2nd Edition

We offer a 14 days free trial software program for small businesses in India. Stay GST compliant with us!